Corporate card

Eatery’s new corporate cards end receipt chaos

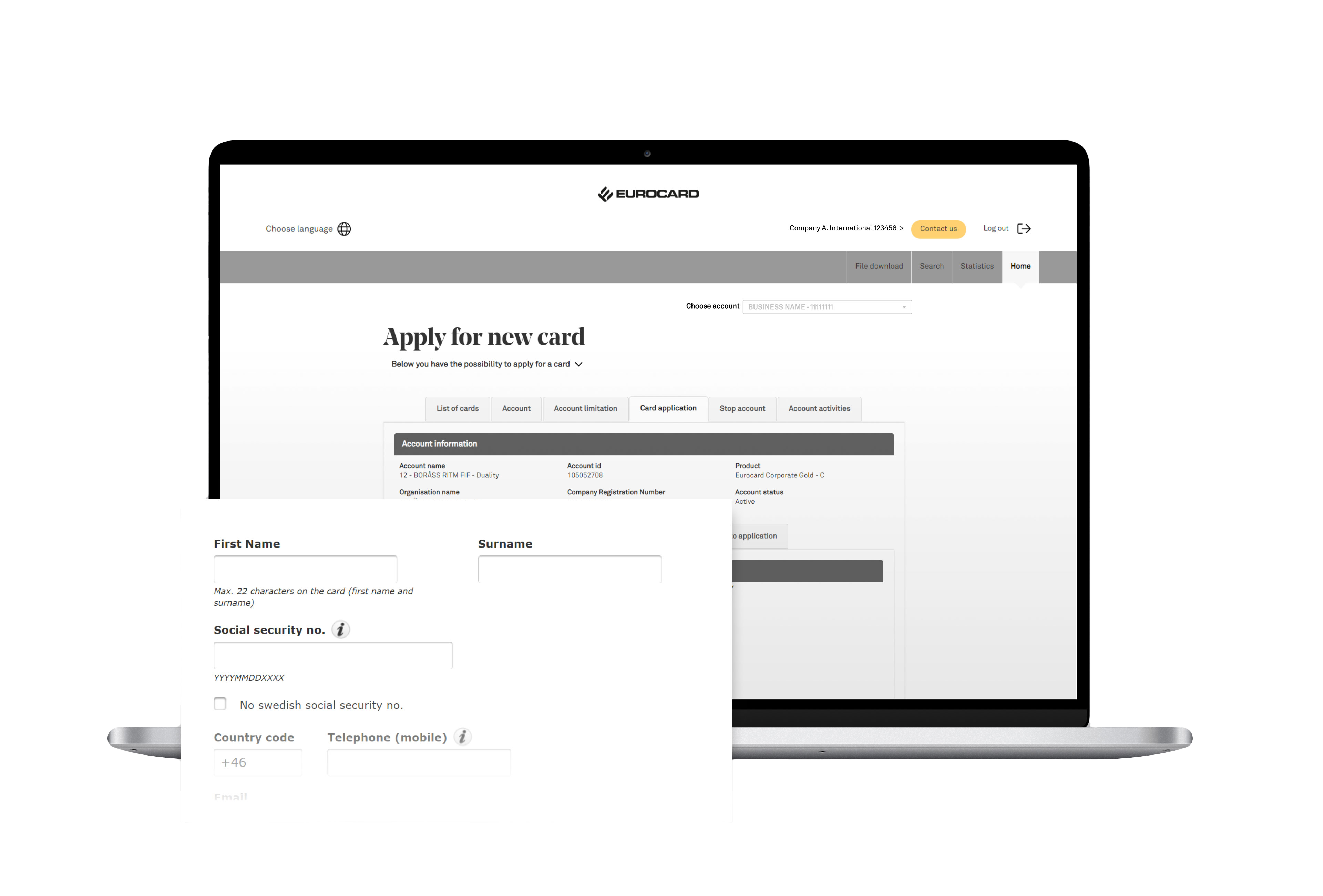

Reams of paper receipts and complicated expense management have become a thing of the past for the Eatery Group. New corporate cards and smart receipts have allowed it to take back control while significantly reducing administrative tasks.